Global Factor Views: Macroeconomics favour Quality and Low Volatility stocks

- 19 August 2024 (5 min read)

KEY POINTS

In Europe and the US, inflation is not far from the central banks’ targets but there are signs that economic growth is slowing. US payroll data was weaker than expected in July, raising concerns that macroeconomic conditions may slow more than anticipated, unsettling equity markets.

A backdrop of slowing inflation and softer macro data means that markets expect interest rates to fall as central back attention switches to managing growth and labour market risks.

In addition, the Institute for Supply Management (ISM) New Orders Index declined in July which resulted in the macro indicator on our factor dashboard switching to a ‘deceleration’ phase.1

- VGhlIElTTSBOZXcgT3JkZXIgSW5kZXggbWVhc3VyZXMgdGhlIG51bWJlciBvZiBuZXcgb3JkZXJzIGZyb20gY2xpZW50cyBvZiBtYW51ZmFjdHVyaW5nIGNvbXBhbmllcyByZXBvcnRlZCBieSBzdXJ2ZXkgcmVzcG9uZGVudHMgdmVyc3VzIHRoZSBwcmV2aW91cyBtb250aC4=

Equity factor outlook

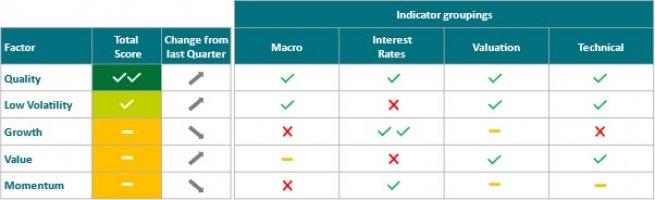

Given the current macro and interest rate backdrop we have updated our Global Factor dashboard – see below:

AXA IM Equity Factor Dashboard: August 2024

Source AXA IM, August 2024.

In August, after measuring the macro, interest rates, valuation and technical indicators, the highest ranked factors were found to be Quality and Low Volatility while Value and Momentum were the lowest ranked.

Low Volatility is the most improved factor compared to last quarter - it typically performs well in slowing macro conditions while valuation and technical remain supportive. Momentum has fallen to the bottom of scorecard, though its aggregate score is neutral. Presently few factor scores are at extremes and, for now, there is little difference between the total score for Growth, Value and Momentum.

We set out in detail our outlook for equity market factors below.

Quality: Positive

Our factor dashboard continues to have a positive ranking for Quality. Quality stocks – those with premium levels of profitability - tend to be rewarded when macro sentiment is in a ‘deceleration’ phase of the cycle. Overall, the valuation of Quality is trading at a premium to the average level; however, unlike other factors, Quality’s performance has not historically been sensitive to periods of high valuation. We would recommend an active approach to Quality investing with a focus on forecast Quality which is more adaptive to changing economic conditions.

Low Volatility: Positive

Low Volatility is now positively ranked on our factor dashboard and is the most improved factor compared to last quarter. The improvement has been driven by our macro indicator pillar moving into a deceleration phase of the cycle, which typically favours the Low Volatility factor. While falling interest rates often weigh on the performance of Low Volatility, this is normally due to the cycle moving into a recovery phase, rather than current conditions where rates are falling to manage a growth slowdown. Because Low Volatility has been out of favour recently, its valuation and technical indicators are also supportive.

Growth: Neutral

Growth is neutral-ranked on our factor dashboard. Our macro indicator, which is based on the level and rate of change of the ISM New Orders Index, is now in a deceleration phase of the cycle which, historically, does not tend to favour the Growth factor. This headwind is however tempered by prospects of falling interest rates – something that is typically supportive of Growth. Strong first-half performance for Growth has resulted in the factor becoming ‘crowded’- i.e. very popular - which results in a negative score on technical indicators.

Value: Neutral

Value - stocks which appear to be trading for less than their underlying worth - is also neutral-ranked on our factor dashboard. Slowing macro momentum has not historically been supportive for Value, given the factor exposure to more cyclical parts of the market. Falling interest rates also weigh on the outlook for Value as investors typically favour longer duration growth stocks as rates fall. Value’s valuations, however, are reasonably attractive on some measures, alongside technical factors which are also supportive.

Momentum: Neutral

Price momentum as a factor captures stocks that have a positive price change, relative to the market, over the last 12 months. And Momentum was the highest ranked factor for much of 2023 and the first quarter (Q1) of 2024. Its ranking fell in April after its technical score deteriorated. Specifically, momentum stocks at the end of Q1 were starting to exhibit low levels of performance dispersion, which is an indicator of factor crowding and, historically, a warning signal for the factor.

While the crowding issue has not deteriorated has since April, it remains elevated, and this continues weigh on the factor’s overall score. Furthermore, slowing macro momentum is also typically negative for Momentum and, as such, it has now moved to be the lowest-ranked factor on our dashboard.

Disclaimer

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.