Inflation-linked bonds: more than just inflation

- 10 July 2024 (3 min read)

With inflation expected to be more uncertain and volatile than in the previous decade, investors may want to consider hedging the inflation risk of their portfolios. Inflation continues to edge towards central bank targets, however with stickiness in services’ sector inflation and some base effects, there could be some bumps along the way to the desired 2% level. This suggests investing in inflation-linked bonds may be an option to mitigate against this sticky inflationary environment.

At the beginning of 2024, we explored why investors may still want to consider inflation linked bonds in a falling inflationary environment1 . Many of the reasons mentioned then still apply now. In particular, the fact that inflation risk remains tilted to the upside. This continues to be a focus with the upcoming elections creating uncertainty over whether governments will be able to reduce public deficits or if it could lead to increased borrowing. Along with political uncertainty, geopolitical tensions and climate change concerns are other aspects that may slow the disinflationary march. We think it is therefore still relevant to consider inflation-linked bonds within a portfolio.

- PGEgaHJlZj0iaHR0cHM6Ly9jb3JlLmF4YS1pbS5jb20vcmVzZWFyY2gtYW5kLWluc2lnaHRzL2ludmVzdG1lbnQtc3RyYXRlZ3ktdXBkYXRlcy9mdW5kLW1hbmFnZXItdmlld3MvZml4ZWQtaW5jb21lL3doeS1jb25zaWRlci1pbmZsYXRpb24tbGlua2VkLWJvbmRzLXlvdXItYXNzZXQtYWxsb2NhdGlvbiI+V2h5IGNvbnNpZGVyIEluZmxhdGlvbi1saW5rZWQgYm9uZHMgaW4geW91ciBhc3NldCBhbGxvY2F0aW9uIHwgQVhBIElNIENvcmUgKGF4YS1pbS5jb20pPC9hPg==

Why Inflation Linked Bonds remain relevant

In rising inflationary environments, it is quite natural to consider inflation-linked bonds and to appreciate what they can offer to a portfolio. As inflation-linked bonds total return is a function of inflation indexation and the change in real interest rates, when inflation expectations rise, inflation-linked bonds tend to outperform their nominal counterparts which has been the case in the post-COVID period.

However, even in a low inflation environment, inflation-linked bonds may improve the risk adjusted returns of a portfolio as they tend to not correlate with stocks or other fixed income assets. Therefore, in stable & low inflation environments, we would expect inflation-linked bonds to deliver a performance close to their nominal counterparts. This has been seen historically in low inflation environments such as before COVID.

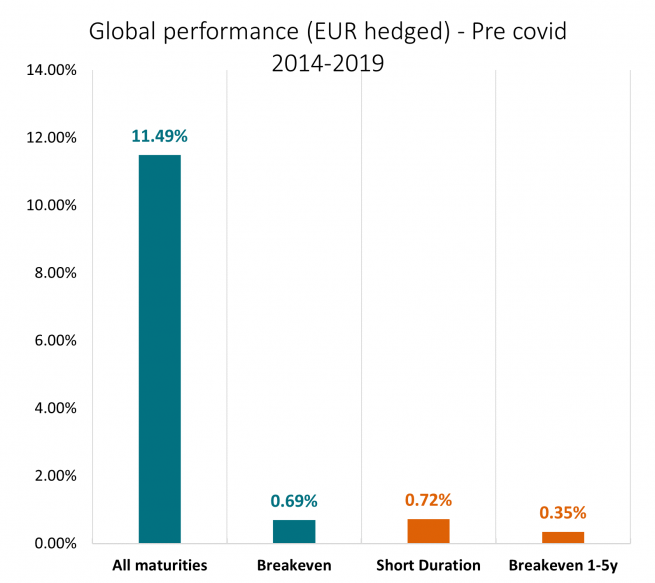

Total and relative (breakeven) performance of inflation linked bonds universe

All maturities ~9y of duration and short duration ~3y.

Source: AXA IM, Bloomberg as at 29/12/2023

Source: AXA IM, Bloomberg as at 29/12/2023

Breakeven performance signals the outperformance (or underperformance) of inflation-linked bonds relative to a comparable nominal bonds’ universe.

How to make the most of ILBs

At the moment, with real interest rates still in restrictive territory and growth expected to be subdued, long duration positions remain attractive. However, as central banks begin to cut interest rates, the front end and the steepeners positions should begin to look more attractive. This need to adjust duration allocation in order to optimise returns, is seen in the charts above, reflecting how each segment of the curve (front end and long end) have performed in different inflationary environments. We believe this demonstrates that taking an active approach to an investor’s inflation portfolio may be help to achieve better risk-adjusted returns.

The history from the past decade offers evidence that diversification within an inflation-linked bond portfolio may help investments from either credit-related events like the Euro Area crisis in 2011 and 2012 or duration swings such as 2022/2023. Not only should an inflation-linked bond global approach offer a better risk/return profile thanks to its diversification benefits, but we believe that there are broader opportunities available within a global approach than that of a local focus.

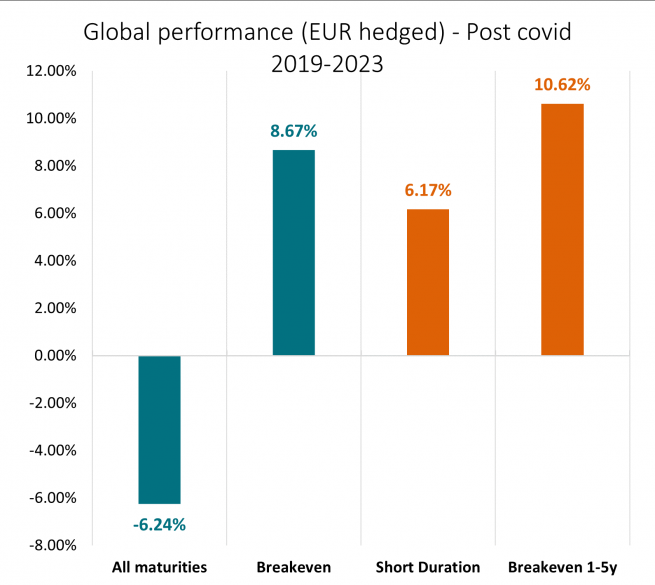

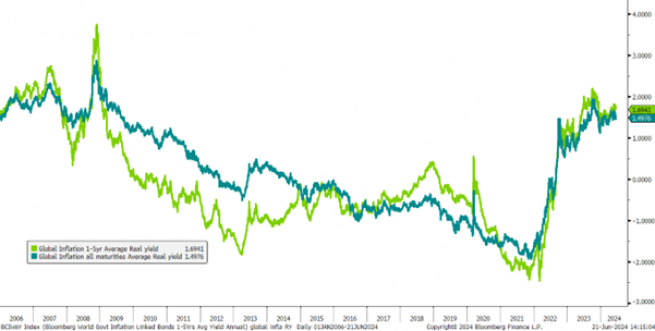

A global approach will tend to favour relatively higher real interest rates and, as a consequence, may maximize investors’ income adjusted for inflation. As the chart below shows, real rates remain in positive territory. We do not, therefore, expect them to subtract income to the asset class, unlike the past 10 years.

Average real yield – Global Inflation linked bonds universe.

Source: AXA IM, Bloomberg as of 21 June 2024

Likewise, a flexible active strategy may also bring value to the table by leveraging on seasonal inflation swings. A flexible approach should be able to allocate assets where inflation accruals are the sharpest and potentially benefit from seasonal patterns or structurally higher inflation.

Although we face a disinflationary environment, inflation risks remain tilted to the upside, so in the medium term, inflation-linked bonds may still have a role in mitigating against this risk. They can also play a broader role in a portfolio, offering investors diversification and low correlation to other investments without necessarily taking on additional credit risk.

Disclaimer

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.