Adding to the toolkit: inflation-linked bonds

- 13 July 2022 (3 min read)

When looking to mitigate against the effects of inflation, inflation-linked bonds can be an important tool in an investor’s kitbag. Knowing how they work and what they can do is, therefore, important.

Inflation-linked bonds help against inflation risk because they link a bond’s principal value (the amount to be paid at the end of the bond’s life) to the price index such as CPI that reflects the rate of inflation. As a result, inflation-linked bonds are more than a coupon strategy as indexation to inflation is impacting the bond’s principal that as a result grows over time.

If inflation is 2%, the principal value of an inflation-linked bond will increase by 2% each year until the bond matures. This process is known as inflation indexation.

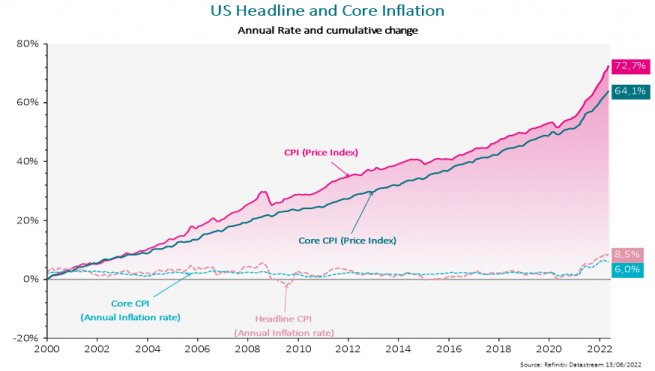

In practice, if an investor had bought an US inflation linked bond in 2000 and held it until today1 , its principal would have increased to 173, protecting the real value of the investment. In the case of a nominal bond of the same characteristics the repayment would have been 100.

Alongside this, as coupons are paid based on a percentage amount of the principal, the coupon payments will also increase. This is how inflation-linked bonds can help investors mitigate the impact of inflation on their portfolios and protect the real value of their assets

Providing a real yield for investors

On top of this, as inflation indexation is guaranteed by the issuer, inflation-linked bonds also provide investors with a real yield. Real yields represent the premium that investors can lock-in on top of realized inflation.

The real yield added to the inflation indexation forecast will give the equivalent to a running yield that could be compared to the yield of a nominal bond. This calculation is known as the total income of an inflation linked bond.

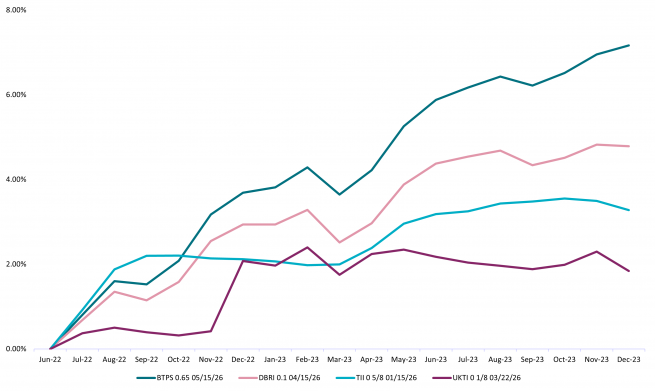

As this chart shows, in most cases inflation is published monthly so the income is not a straight line and would differ from one month to another. This also demonstrates that high inflation should mean high income for inflation-linked bonds.

Inflation-linked bonds can offer investors an income that is adjusted to reflect inflation and so may help reduce the erosion inflation can cause to their portfolio value. As well as understanding the methods used to calculate an inflation-linked bond’s value, there are other elements to consider when deciding how to invest in these bonds. In the next in the AXA IM Inflation Series, we will look at duration and how this impacts inflation-linked bonds.

Inflation

Inflation can erode the real returns of investments however tools like inflation-linked bonds could help investors mitigate the effects of inflation on their portfolio.

Find out more

Watch the other modules from our inflation series

The objective of this series is to make inflation-linked bonds investing simple to investors.

- [1] As at 13/06/22

Disclaimer

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.